Kraken Reports Record 2021 Financial Results

Q4 Revenue of $15.0 million and Adjusted EBITDA of $3.0 million

Annual Revenue Increases by 109%

ST. JOHN’S, NEWFOUNDLAND, April 28, 2022 /GLOBE NEWSWIRE/ — Kraken Robotics Inc. (TSX-V: PNG, OTCQB: KRKNF), Canada’s Ocean Company, announced it has filed its financial results for the quarter and year ended December 31, 2021. Additional information concerning the Company, including its consolidated financial statements and related management’s discussion and analysis (“MD&A”) for the quarter and year ended December 31, 2021, can be found at www.sedar.com. Unless otherwise stated, all dollar amounts are Canadian dollar denominated.

Q4 2021 Financial Highlights

- Revenue for Q4 2021 was $15.0 million compared to $2.1 million in the prior year and driven by delivery by the delivery of a minehunting system to the Remontowa shipyard for the Polish Navy, the continued work with the Royal Danish Navy on multiple minehunting systems, the addition of PanGeo Subsea in July 2021 and multiple deliveries of our AquaPix® synthetic aperture sonar (SAS) and SeaPower™ batteries.

- Gross margins in Q4 2021 were 43% as compared to 49% in 2020 due to the change in product mix and the acquisition of PanGeo Subsea.

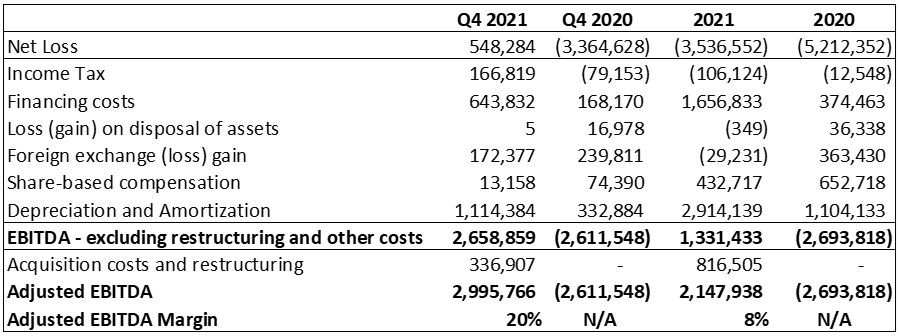

- Adjusted EBITDA(1) for the quarter was $3.0 million, a 20% Adjusted EBITDA Margin(1) compared to an Adjusted EBITDA loss of (1) of $2.6 million in the comparable quarter.

2021 Financial Highlights

- Revenue for the year ended December 31, 2021, was $25.7 million versus $12.3 million in the prior year. The more than 100% year-over-year revenue growth was driven by the delivery of a minehunting system to the Remontowa shipyard for the Polish Navy, the continued work with the Royal Danish Navy on multiple minehunting systems, the addition of PanGeo Subsea in July 2021 and multiple deliveries of our AquaPix® synthetic aperture sonar and SeaPower™ batteries.

- Gross margins for 2021 were 44% as compared to 48% in 2020 due to the change in product mix and the acquisition of PanGeo Subsea.

- Adjusted EBITDA(1) for the year was $2.2 million, an 8% Adjusted EBITDA Margin(1), compared to an Adjusted EBITDA loss(1) of $2.6 million in the prior year.

- Net loss for the year totaled $3.5 million compared to a net loss of $5.2 million in the prior year.

- Cash balance at year end 2021 was $6.8 million and $12.9 million as of December 31, 2020.

- Working capital at year end 2021 was $6.4 million, compared to $10.4 million as of December 31, 2020, and includes $3.8 million for the current portion of contingent consideration associated with the acquisition of PanGeo Subsea and may be satisfied by way of a cash payment equal to 50% of the contingent consideration and the issuance of Common Shares having an aggregate value equal to the remaining 50%.

- Total assets were $65.5 million at year end 2021, as compared to $34.8 million as of December 31, 2020, with the increases driven by the acquisition of PanGeo as well as increased accounts receivable and inventory associated with a higher revenue base.

- At year end 2021, Kraken had $15.0 million in previously awarded non-repayable funding to draw upon from government agencies and project partners for research and development, of which cash amounting to $3.6 million has been received for contracts to be completed in 2022.

- Adjusted EBITDA is a non-GAAP financial measure and Adjusted EBITDA Margin is a non-GAAP ratio, in each case with no standard meaning under IFRS, and may not be comparable to similar financial measures disclosed by other issuers. Refer to the “Non-GAAP Measures” section of this press release.

CEO Comments

“Despite COVID and global supply chain challenges, we delivered strong results in 2021 driven by the exceptional execution and hard-working performance of our entire team,” said CEO Karl Kenny. “We advanced our growth strategy through innovation and business investments that make a real difference to our customers, and we remain committed to this strategy. Given the global geopolitical risks we continue to see increased defense industry interest in our KATFISH™, AquaPix® synthetic aperture sonar, and SeaPower™ battery products as international Navies look to upgrade their dated naval minehunting equipment. In the commercial market, we also expect PanGeo to have strong growth as customer demand for their services is being driven by offshore energy and renewables customers and as PanGeo integrates Kraken technologies (such as KATFISH™ and SeaVision®) into their recurring service delivery model. In the offshore wind market, PanGeo is benefitting as customers start to develop in deeper water and areas with more complex soil conditions. Recent wind farm license auctions in the US and Europe and major offshore wind announcements by energy companies such as Shell and Equinor show that the trend towards offshore wind and offshore renewables is accelerating. We expect to be a beneficiary of this market growth.”

Financial Guidance for 2022

For 2022 we expect revenue to be in the $36.0 – $42.0 million range, with adjusted EBITDA expected to be in the $5.0-$7.0 million range. Operational results in 2022 will be driven by the continued delivery of systems to the Royal Danish Navy, a full year impact from the acquisition of PanGeo and continued deliveries of our AquaPix® synthetic aperture sonar and SeaPower™ battery products. During 2022, Kraken is expected to receive progress payments on two large contracts amounting to $14.4 million.

2021 Operational Highlights

On the Product Side

- The main focus was on executing on KATFISH™ and ALARS contracts for the Danish and Polish navies. Supply chain challenges were significant and continue to be a headwind, but our teams have worked very hard to best navigate issues that arise. In addition to contributing to solid revenue and profits, the Polish and Danish wins represent significant new reference customers for Kraken in the mine countermeasures (MCM) space. We are in active discussions with other defense companies and navies as geopolitical uncertainty is driving increased interest in Kraken products from the defense industry.

- Our subsea battery business saw improved order activity and revenue as we added customers in the commercial market. We continue to work towards US Navy certification for our lithium polymer batteries and expect testing to occur with the US Navy this year under a Cooperative Research and Development Agreement. We expect this certification will open new opportunities for our subsea batteries in underwater vehicles. A recent $5 million battery order from a defense industry customer provides a solid base to 2022 battery revenue.

- For our AquaPix® synthetic aperture sonar sensors, we have seen increased interest for our modular sensors in both the AUV OEM space and with defense customers. We expect growing activity with our new light-weight synthetic aperture sonar for man portable AUVs. While we have integrated our SAS to over 20 unique vehicle platforms, we continue to invest significantly in sonar R&D, offering innovative new features and solutions to the market which is seeing a growing number of programs of record finally coming to market.

On the Services Side

- Service-related revenue in 2022 represented less than 15% of consolidated revenue, but with the acquisition of PanGeo in Q3, 2021, and investment into our KATFISH™ and SeaVision® services assets and team, we expect Services revenue to become a solid contributor to Kraken’s growth going forward. A recent $5 million services contract for PanGeo for a job in the Gulf of Mexico is evidence of this.

- The PanGeo acquisition closed at the end of July 2021 and significant efforts have been made to align the organizations and integrate the teams. Kraken’s technologies such as KATFISH™ for high resolution seafloor surveys and SeaVision® for subsea infrastructure inspection are being folded into the PanGeo service delivery model.

- In 2021, Kraken completed its first commercial services job generating $0.8 million in revenue from a survey of a submarine cable for a North American utility. Kraken completed numerous SeaVision® inspection jobs with customers in offshore wind and offshore energy in applications such as mooring chain inspection and offshore wind farm anode inspections.

NON-GAAP MEASURES

Non-GAAP measures, including non-GAAP financial measures and non-GAAP ratios not recognized under IFRS are provided where management believes they assist the reader in understanding Kraken’s results. The Company utilizes the following terms for measurement within the MD&A that do not have a standardized meaning or definition as prescribed by IFRS and therefore may not be comparable with the calculation of similar measures by other entities and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP.

Adjusted EBITDA and Adjusted EBITDA Margin

The Company believes that, in addition to conventional measures prepared in accordance with IFRS, Adjusted EBITDA is useful to securities analysts, investors and other interested parties in evaluating operating performance by presenting the results of the Company on a basis which excludes the impact of certain non-operational items which enables the primary readers of the MD&A to evaluate the results of the Company such that it was operating without certain non-cash and non-recurring items. Adjusted EBITDA is calculated as earnings before interest expense, interest income, income taxes, depreciation and amortization, stock-based compensation expense and non-recurring impact transactions, if any.

Adjusted EBITDA Margin is defined at Adjusted EBITDA divided by Total Revenue. Working capital is defined as current assets less current liabilities.

LINKS

SOCIAL MEDIA

LinkedIn www.linkedin.com/krakenrobotics

Twitter www.twitter.com/krakenrobotics

Facebook www.facebook.com/krakenroboticsinc

YouTube www.youtube.com/channel/UCEMyaMQnneTeIr71HYgrT2A

Instagram www.instagram.com/krakenrobotics

ABOUT KRAKEN ROBOTICS INC.

Kraken Robotics Inc. (TSX.V:PNG) (OTCQB: KRKNF) is a marine technology company dedicated to the production and sale of software-centric sensors, subsea batteries and thrusters, and underwater robotic systems. The company is headquartered in Newfoundland with offices in Canada, U.S., Germany, Denmark, and Brazil. In July 2021, Kraken acquired PanGeo Subsea, a leading services company specializing in high-resolution 3D acoustic imaging solutions for the sub-seabed. PanGeo with offices in Canada, the United States and the United Kingdom is now a wholly owned subsidiary of Kraken. Kraken is ranked as a Top 100 marine technology company by Marine Technology Reporter.

Certain information in this news release constitutes forward-looking statements. When used in this news release, the words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “seek”, “propose”, “estimate”, “expect”, and similar expressions, as they relate to the Company, are intended to identify forward-looking statements. In particular, this news release contains forward-looking statements with respect to, among other things, business objectives, expected growth, results of operations, performance, business projects and opportunities and financial results. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Such statements reflect the Company’s current views with respect to future events based on certain material factors and assumptions and are subject to certain risks and uncertainties, including without limitation, changes in market, competition, governmental or regulatory developments, general economic conditions and other factors set out in the Company’s public disclosure documents. Many factors could cause the Company’s actual results, performance or achievements to vary from those described in this news release, including without limitation those listed above. These factors should not be construed as exhaustive. Should one or more of these risks or uncertainties materialize, or should assumptions underlying forward-looking statements prove incorrect, actual results may vary materially from those described in this news release and such forward-looking statements included in, or incorporated by reference in this news release, should not be unduly relied upon. Such statements speak only as of the date of this news release. The Company does not intend, and does not assume any obligation, to update these forward-looking statements. The forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange Inc. nor its Regulation Services Provide (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release, and the OTCQB has neither approved nor disapproved the contents of this press release.

For further information, please contact:

Joe MacKay, Chief Financial Officer

(416) 303-0605

jmackay@krakenrobotics.com

Greg Reid, Chief Operating Officer

(416) 818-9822

greid@krakenrobotics.com

Sean Peasgood, Investor Relations

(647) 955-1274

sean@sophiccapital.com

Leave A Comment